Secore Advisors Group, LLC

A comprehensive financial services firm committed to helping our clients improve their long-term financial success.

Secore Advisors Group, LLC is a comprehensive financial services firm committed to helping our clients improve their long-term financial success. Our customized programs are designed to grow, and conserve our clients wealth by delivering an unprecedented level of personalized service.

Peter Klein CFA, is director of advanced markets and underwriting at Secore Advisors Group, LLC, with more than 25 years of experience in life products, strategic corporate solutions, including succession planning, keyman policies, premium finance estate and retirement planning.

Klein started his career with Travelers Insurance Company in private placements and investments, where he received extensive training on insurance products.

He has authored over a dozen articles including the risk of owning a business, estate planning, retirement challenges, protecting personal assets, and trends in human longevity and the importance of a policy review.

Klein provides consulting services to life insurance general agencies and independent marketing organizations. He holds two graduate degrees, an MS in science and an MBA from the University of Connecticut.

Klein can be reached by telephone at 317-414-1205.

Our Specialties

View Our Specialties

- Advanced Underwriting– Have a history of getting clients underwritten by Carriers even though they had been declined by multiple carriers in the past. I offer a redundant underwriting process that may include contacting the client’s doctor, amending and updating of notes and my ability to professionally engage the Carrier’s underwriter to debate and clarify medical information.

- Developed a Segmented Marketing Approach– such as Private Business Owners and C-Suite Initiative. Our sales initiative is based on the concept presented in the book “The Millionaire Next Door.” People who own and operate a business are more likely to amass wealth.

- Advanced Markets– We offer support services in the area of premium finance. We also have programs for personal asset protection, the creation of fire-walls (silos), non-recourse financing of life insurance, and other tactical options that every business owner should consider.

- Policy Review – Provide comprehensive third party review of Universal Life Policies. Because of UL’s efficient premium relative to size of death benefit, have become the predominant permanent policy used in estate planning and corporate Keyman situations. But UL policies came with some risks since the endowment guarantees were not there, and policyholder had to accept mortality and interest earnings risks.

- Premium Finance Support — Business owners are used to using leverage and so are great candidates for premium finance solutions. Extraordinary low interest rates in combination with weak cash flows of private business, provide an ideal climate for premium finance of key man insurance policies. Given my lending experience, I am able to offer highly sophisticated fully vetted premium finance solutions.

- Foreign National Cases – I have proven expertise in qualifying foreign nationals with US Carriers. Typically, US carriers require a higher protocol in reviewing and approving foreign nationals. Difference in cross border medicine and its practice can present a hurdle in getting underwriting approval from the limited number of US carriers that actually consider foreign nationals.

- Targeting female clients– I have marketing materials and tools that can be very effective in working with female clients without coming across as patronizing. Women routinely outlive men of the same age from 5 to 8 years. Women fail to appreciate the impact of good health and matrilineage. A women who turned 65 in 1990 had an average life expectancy of 84.6, but in many cases of what I term matrilineage, many women live into their 90’s as did their mothers and grandmothers. Given their longevity, women face significantly greater challenges compared to men. My article on Gender Differences in Longevity was designed to provide a foundation for this targeted marketing initiative. I have found some success in targeting single executive women, typically CFO’s of private or public companies.

How We Help Clients

View How We Help Clients

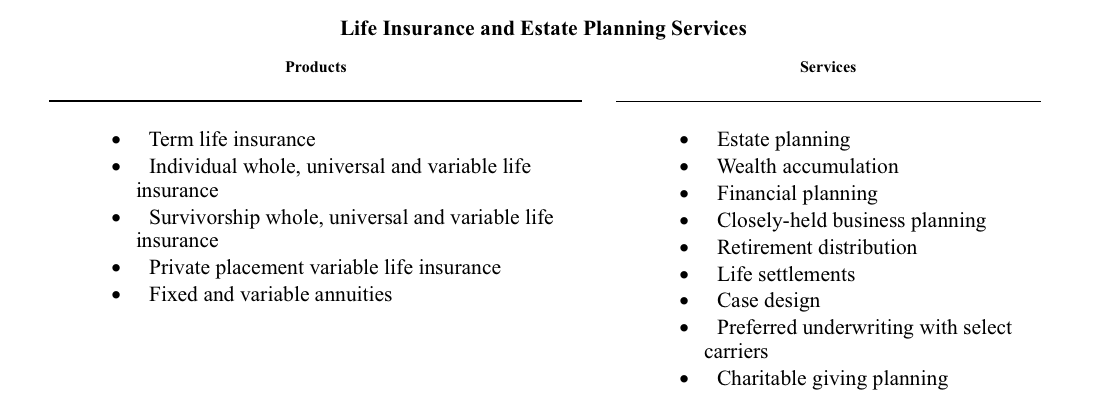

We provide a comprehensive set of products and services that enable our high net worth clients to meet their estate planning and benefits needs and our corporate clients to create, implement and fund benefit plans for their employees and executives. The products can generally be classified in three primary areas:

Life insurance and estate planning services

The life insurance products and estate planning services that our firms offer to clients assist them in growing and preserving their wealth over the course of their lives including plans for their estate upon death. We also develop plans for business succession and charitable giving. The life insurance products that our firms distribute provide clients with a number of investment premium payment and tax deferment alternatives.

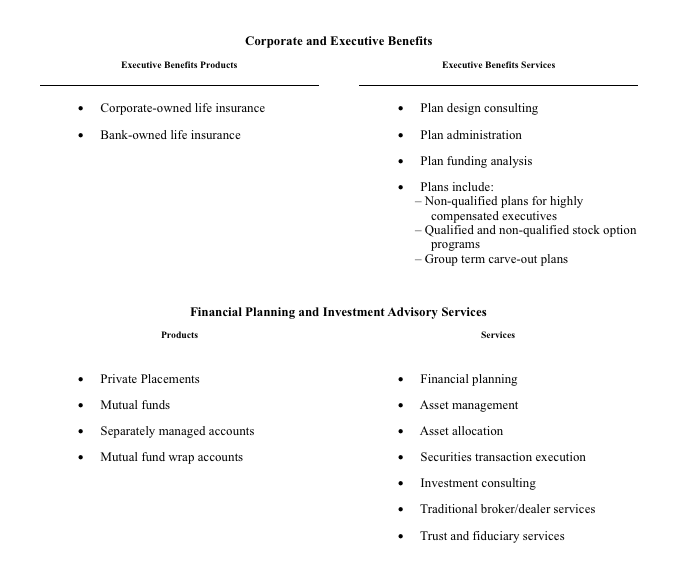

Corporate and executive benefits

Our firms distribute corporate and executive benefit products and offer related services to corporate clients. Using these products and services, our firms help clients design, fund, implement and administer benefit plans for their employees. Corporate benefit plans are targeted at a broad base of employees within an organization and include, among others, products such as group life, medical and dental insurance. Executive benefit programs are used by companies to compensate key executives often through non-qualified and deferred compensation plans.

Financial planning and investment advisory services

Our firms help high net worth clients evaluate their financial needs and goals and design plans to reach those goals through the use of third-party managed assets. We contract with third-party asset managers to provide separately managed accounts, wrap accounts and other investment alternatives to our clients.

Our firms serve their client base by providing some or all the products and services summarized below in one or more of the following primary areas.

Competition

We face substantial competition in all aspects of our business. Our competitors in the insurance and estate planning business include individual insurance carrier sponsored producer groups, captive distribution systems of insurance companies, broker-dealers and banks. In addition, we also compete with independent insurance intermediaries, boutique broker-general agents and local distributors including M Financial Group, Crump BISYS Group, Inc., and National Financial Partners, (NFP) and its affiliate, Highland Capital. We are competitive due to the independence and resourcefulness of our producers, our “open architecture” platform, and the overall strength of our business model, and the technology-based support services created and the training resources available to our firms and producers.

Regulation

The financial services industry is subject to extensive regulation. Our firms are currently licensed to conduct business in all states, including Alaska and Puerto Rico and are subject to regulation and supervision both federally. In general, this regulation is designed to protect clients and other third parties that deal with our firms and to ensure the integrity of the financial service providers.

Licensure

In general, life insurance sales agents must obtain a license in the States where they plan to work. Separate licenses are required for agents to sell life and health insurance. In most States, licenses are issued only to applicants who complete specified prelicensing courses and who pass State examinations covering insurance fundamentals and State insurance laws.

As the demand for financial products and financial planning increases, many insurance agents, especially those involved in life insurance, are choosing to gain the proper licensing and certification to sell securities and other financial products. Doing so, requires passing either the Series 6 or Series 7 licensing exam, both of which are administered by the National Association of Securities Dealers (NASD). The Series 6 exam is for individuals who wish to sell only mutual funds and variable annuities, whereas the Series 7 exam is the main NASD series license that qualifies agents as general securities sales representatives.

How We Work With Property Casualty Agencies

View How We Help Property Casualty Agencies

P&C Agency Situation Analysis

There are three distinct types of P&C agencies, the very large national agency, such as Marsh, AON, Gallagher, and Willis (multinational agencies with offices in every major city in the U.S.), local/regional P&C agencies that may employ 20 or people, and small mom and pop agencies. The regional P&C agencies face the risk of losing their most profitable clients to the national full service P&C Agencies who dominate.

Regional P&C Agencies

Alternatively, regional P&C agencies are sometimes reluctant to recruit specialized support firms to assist them in building a closer more resilient relationship with their clients, and aggressively defend themselves against multinational players.

We, at Secor, recognize how important that client relation is to a P&C agency. It takes years to win over a client but only one bad episode to put that relationship into jeopardy. Each client represents a recurring revenue stream that when compiled with other clients can mean the difference between covering an agency’s fixed overhead or not.

Our Support of Regional P&C Agencies

Our program is designed to work with P&C agencies and their clients. We have a developed a sophisticated process that engages a client in a professional manner utilizing advanced communication techniques. Through our educational tools, we empower the client to participate in developing an estate building strategy. Our process educates a client and presents to that client options that lead to better decisions and future realizations with less risk.

Client First Solutions

When it comes to financial planning and investing, people are hard wired to see the world the way it was while all the while capital markets have changed dramatically from just a couple of years ago. Change is accelerating. All around us the cycle of progress and obsolescence is accelerating. Most clients’ only have a peripheral understanding of securities, capital markets and taxation, and so are dependent on qualified professionals to develop a game plan based on understanding the fundamental changes in the market place.

We help clients understand the world as it really is and potential risk and uncertainty in the market place.

The Fourth Estate

We have developed a strategic concept that we call the fourth estate. It is a diversification program that allows clients to achieve more consistent asset build up with less dependence on a volatile market place.

How Our Support Program Differs?

Superior “client first” educational process that empowers the client

Our professionals have a corporate background with a unique ability to connect with corporate leadership

Superior marketing and educational tools

Customized mortality curve analysis

Advanced underwriting capabilities – we have in-house expertise in medicine and disease morphology and first hand knowledge on which carriers offer advanced underwriting and for which type of disease

Ability to take detailed financial information and break it down to understandably terms and options

Longevity Trends

View All Articles

- CLPR Report Sample – Female, 70

- Agent’s Sales Journal – Life Expectancy an Important Retirement-Planning Tool

- Annual Longevity Mortality Curve

- Broker World – The Fourth Estate

- Broker World – Trends in Longevity and Carrier Underwriting Standards

- Broker World – You have Two Ages, Chronological & Biological, – And How They Differ Matters!

- Broker World – Why Policyholders Needs to Consult with an Insurance Specialist!

- Broker World – Reality Check for Financial Plans

- LifeHealthPRO – The Case for Annuities

- Trends in Longevity and Carrier Underwriting Standards

- The Importance of a Mid-Career Financial Checkup

- Missing the Pitch: Why P&C Agencies Fail at Cross-Selling Life Products, and How They Can Improve

- Secular Bull & Bear Markets Profile: 2010

- The Wealth Channel: Small Business Owners Face Realization and Retirement Risks

- The Wealth Channel: Gender Differences in Longevity and Aging

- The Wealth Channel: The Importance of a Mid-Career Financial Checkup

- Facing Aging

- CLiC Customized Longevity Curve Comparison Sample

- CLPR Sample – Male, 50

- CLPR Sample – Male, 58, Smoker

- Family History & Health Status Questionnaire Sample

Marketing Tools

Underwriting

Secore Advisors has established an advanced underwriting process, to provide the full scope of support and servicing of our financial professionals and their clients.

◊ Proprietary Evaluation Tools – Developed proprietary medical screening forms that includes family medical history.

◊ Advanced Medical Review – Advanced in-house medical underwriters review medical records prior to submission.

◊ Prepare In-house Medical Summary – Facilitate and manage underwriting results from the carrier by preparing a medical summary and overview of client’s health status and medical challenges. Relevant medical information is reviewed and sum-marized in a cohesive but balanced perspective.

◊ Ability to Debate Carrier’s Preliminary Underwriting – Our advanced underwriting staff have the ability to debate with carrier’s underwriting staff, while our customized mortality curve analysis allows us to validate carriers ratings conclusions.

View Details

Secore Advisors has established a redundant life product underwriting process, to provide the full scope of support and servicing on behalf of financial advisors.

Our comprehensive life insurance support system allows a financial advisory to focus on what they do best which is service their client.

The Secore framework combined with our process produces consistent results that meet compliance requirements and facilitates consistent performance on behalf the client.

The same passion that drives financial advisors to provide solutions for their clients can result in underwriting and processing challenges. The Secore process is designed to screen, qualify Life Insurance cases while providing the structure to compile the necessary set of documents to facilitate underwriting. Our process centered Life Insurance system allows us to offer a compliant and controlled approach for your client’s insurance needs.

Secore Offers Consistent Independent Third Party Solutions to Financial Advisors and their clients. The service provides a broad range of solutions that facilitate the expansion and augmentation of their business:

- It can address existing book of business Issues – As clients’ needs for life insurance change over time, so may their need for the coverage afforded by policies they own. Secore solutions can facilitate a customer’s changing needs for coverage.

- It can be used to grow and expand an FA’s client base – Our process can facilitate the recruitment of new clients.

Case Screening and Qualification Solution – Secore has developed a screening tool kit that facilitates the screening and qualification of prospective cases.

Redundant Underwriting Process – Secore offers a redundant underwriting process that creates a bake-off among leading insurance carriers.

Full disclosure – we’ll communicate to you about our business partners and the resources involved in the process, the associated fees, and the compensation.

Fiduciary responsibility – our obligation is to represent you and your clients, and we’ll work hard to earn your loyalty and trust.

Expert case processing – we work with you to determine appropriate pricing for your client’s coverage needs.

Facilitating Front End Sourcing of New Coverage Sales

We would advocate a focused approach to working with our partners and agents in sourcing Life Insurance business opportunities and facilitating the sale of new coverage. In addition, we would implement the following measures to increase the success rates of agents as follows:

- Improve Sales Effectiveness – Provide education and training, along with extensive marketing resources, including promotional and marketing materials and sales tool kits

- Develop Referral Program – Facilitate the sourcing of leads from the sharing of best practices, successful case studies and opportunities, identification of unique repeatable sales opportunities and referrals.

Improve and Expand Servicing of Clients

Servicing will center on active engagement of agents based on follow-up, facilitation backed by extensive resources, including:

- Improve Success Rate – Manage expectations of client and thereby increase success rates.

- Get preliminary medical records

- Prepare preliminary price ranges on new prospective policies

- Get one or more life expectancies

- Develop a more precise price for the policy to provide a basis for bids submitted

- Accelerate Closing Process – Implement an active bidding program that facilitates more rapid bidding. Historically, a Provider has been reluctantly to be the first bidder, since typically the first bid is used as a stalking horse to get better bids.

- Create a more dynamic bid process to incentivize an acceleration of the bid process

- Use in-house price information to qualitatively and quantitatively understand the bids submitted and challenge the assumptions of the bidders

- Post Closing Process – Calculate commissions and administer payments to appropriate parties.

Regulatory Issues

- Compliance – Facilitate compliance requirement for each state. About half of the states require some sort of licensing or registration of Life Insurance brokers while the other states have no licensing requirement.

- For Example, New York State requires licensing of viaticle brokers but does not require licensing of Life Insurance brokers.

Florida requires licensing of LSP brokers. A life agent in Florida can file for a LSP license and is effectively grandfathered.

Maintain Records on Policies and Bids – File appropriate state forms or follow-up with agents to facilitate completion of forms, and to supplement record requirements by regulators who may desire to do a look back review of SECORE or client’s procedures. - Develop a Client’s Life Insurance Data Base

- For Example, New York State requires licensing of viaticle brokers but does not require licensing of Life Insurance brokers.

Meeting the Needs of Customers by Providing Superior Service

Historically, the main function of an insurance agency is to collect, compile and distribute information in the sale of new coverage. While most agencies do what it takes to keep the client pacified, we believe in assisting a client to define their actual needs. This in addition to the quality and significance of how information is collected, compiled and distributed will further define customer service. The same expertise that SECORE has brought in the writing of new coverage defines our Life Insurance program.

At SECORE we have identified three broad categories for analyzing customer service: Professional Advice, Effective Communications, and Information Collection and Processing.

Professional advice

Professional advice is a simple concept but often overlooked. It is about an insurance broker that provides in-depth consulting before and after the sale, but also about being perceived as a resource for solving insurance related problems, and not just being an order taker or sales person. Its doing more than what it takes to keep the client pacified. It’s guiding a client beyond what they think they need to assist them in defining what they actually need. Effective organizations create new ways of servicing clients and are constantly looking at ways to improve themselves against an ever-changing business world.

Effective communication

Outside service providers, producers and CSRs must be able to work together under an established lexicon that minimizes communication errors. A service provider must have a communication framework that allows for communications between different parties: clients, producers, other employees, and agents.

Information collection and processing

This requires significant skill on the part of the service provider and producers. Good customer service means knowing what information to gather and how to ask for it. Patience, determination and diplomacy are necessary whether probing the client for pertinent information to complete a form or getting a measure of their expectations. Processing of information is time consuming and SECORE process centered program provides an efficient solution.

Superior customer service

Many clients think they know what services they want and in the case of Life Insurances, they may also have a view on what their policy is worth largely based on anecdotal information. Friends who have sold their policies are only too willing to share information that allows them to upstate their friends and neighbors.

SECORE has access to proprietary pricing software to facilitate benchmarking of a policy’s value. This also facilitates the management of client’s expectations. Procedures can use the price guidelines determined by SECOR to manage the client’s expectation. The client expects documentation to be issued in a timely manner. The client will be surprised to see bid proposal that compares with earlier benchmark quotes.

Process Centered Programs Tend to be More Productive

Typically, service providers that operate as insurance professionals and offer superior customer service are more productive, more profitable and have better retention than the average agency.

It’s not easy to reach this level of service. SECORE has been diligent in developing, implementing and refining procedures and systems that meet the ever-changing needs and expectations of the client. SECORE partners and management have taken the time to develop the support staff and technology to meet the client’s customer needs. A firm that incorporates this approach has a different culture than the herd.

Advantages of a Well-Defined Process as the Primary Driver

SECORE has built a process centered Life Insurance practice. It is based on a Life Insurance tailored management information system that has been deployed by all of our offices. The advantages of a process defined practices are as follows:

- Limits of standalone process tool: The SECORE management information system is an integrated network system that is inherently more effective than a standalone system.

- Making well-informed trade-offs: The combination of a proprietary pricing system and a Life Insurance data management systems allows for a flexible iterative process that allows for making determinations based on well informed trade-offs.

- Mid-course adjustments are essential: The Life Insurance market place is constantly changing and evolving. The buying criteria’s change and the funds that participate are changing. Adjustments have to be constantly made to reflect these changes that take place in the industry. SECORE’s program is set up to make these adjustments and react to these changes.

- Advisor need for education, tools, and process: SECORE provides the education and training that incorporates, not only marketing and sales, but also improving our process to develop a better understanding of the documentation and closing process needs of the client.

Our Wellness/Medical Management Program

Morbidity Risk

As people age, the likelihood that they will be battling chronic illnesses increases. Before the advent of modern medicine, the typical person deteriorated and died on a rather severe downward curve, ending abruptly either from infection and/or organ failure. Today people live longer and enjoy a morbidity curve that is flattening and drawn out, which graphically results in a longer flatter line. This flattening of the morbidity curve in contrast to the steep downward curves of the past, is referred to as squaring the curve. Advances in medicine and preventive care including diet and regular exercise have allowed humans to soldier on and maintain a quality of life, even though they may be suffering from a combination of chronic diseases such as arthritis, heart disease, diabetes and other medical maladies.

Mortality Risk

Many decades ago, there was considerable difference in the life span of the rich versus the poor. Advances in medical technology along with greater access to healthcare, there has been a leveling of the playing field. Today, most people, even those with modest means, have access to state of the art medical care. Consequently, there is no appreciable difference in the life span of a billionaire versus the life span of an educated middle class working person. However, there is an appreciable difference in life span between educated persons who are pro-active and adept at accessing appropriate healthcare compared to uneducated people of more modest means.

Variations in Mortality Rates

One’s lifespan is a function of many factors such as family history, lifestyle, and ability to make effective use of the health care system. Variations in death rates are due to gender and aging characteristics. For example, the two leading killers are heart disease and cancer. These diseases are impacted to some degree by hormones, which are some of the most powerful drugs known to mankind. The typical woman before reaching menopause, is significantly less prone to heart disease due to estrogen and progesterone, while men tend to be more vulnerable to heart disease as a result of testosterone. Cancer in many cases is fueled by hormones. As one ages, hormone levels decline. Consequently, people diagnosed with cancer under the age of 50 are more like to die of the disease than people diagnosed at an older age.

Medical Underwriting and Life Expectancy Estimates

When confronting one’s own mortality, the average person is probably in denial, although that same person may be quick to assign a life expectancy to friends and relatives. Armand Hammer, a well known industrialist and geo-political power broker, worked right up to the day he died at age 96. In fact, six months prior to his death, he had ordered 6 custom tailored suits and 35 pairs of slacks. Obviously, he was too busy maintaining his schedule to take notice of his own mortality. This is common in all of us. The idea of hiring someone to estimate one’s life expectancy (LE) is probably even more of a stretch.

Life Span a Function of Several Factors

A person’s life span is a function of six major factors: Family history (DNA history, vulnerability to inherited disease), lifestyle, (exposure to stress, routine exercise, controlling one’s weight, risking taking), support system (married, supportive family), education, access to healthcare, effective use of that healthcare system and ability to follow the advice of primary care physician, and the personal discipline to maintain a wellness regimen.

Medical Care Excellence

Medicine maybe a science but the practice of medicine is an art and craft. Getting the best out of medical care can’t be taken for granted. Rather it can sometimes be a challenge. The competence and skill sets of physicians can vary widely, and their access to sophistication medical support can also impact their level of medical practice.

For the average person, life expectancy can partly be a function of how competent one is in managing your health care, including the ability to read your body, take preventive measures and knowing when to access the health care system to make effective use of it.

In a world of ever advancing medicine and treatments, a person, who is capable of keeping up with medical advances and effectively utilize the health care system, will have an advantage. Given the long delay for new drugs and medical technology to gain approval in the U.S., patients who can afford it may consider seeking treatment in Europe which offers a more streamlined approval process.